2024 Bitcoin Halving: A Guide

Once every 4 years, like clockwork, Bitcoin undergoes a transformation.

Bitcoin is a scarce digital asset and also a technological breakthrough that allows for digital ownership of an asset without worry of double spending or censorship. It can be used as a digital gold or a medium of exchange.

In Bitcoin's programmed cycle, a significant event known as the halving (or "halvening") is set to occur around April or May of 2024. This event will reduce the rate at which new bitcoins are generated by half, effectively slicing the rewards received by Bitcoin miners for their mining efforts.

This halving mechanism is a fundamental aspect of Bitcoin's design, aiming to control the supply of new bitcoins into the market and mimicking the scarcity-driven appreciation often seen in precious metals like gold.

In this post, we will be covering:

What is Bitcoin halving?

Why does halving matter?

How does this affect Bitcoin?

Let’s dive in.

What is Bitcoin halving?

“Halving” is the cut in upcoming supply of Bitcoin produced by Bitcoin miners. Let’s see how this works:

Bitcoin is a network of computers that runs the same software - the Bitcoin software1.

The computers do work on behalf of the Bitcoin network. The computers are referred to as “miners”. 2

The miners help the Bitcoin process transactions, such as transfers of Bitcoins between people.

After processing a transaction, one of the miner computers will earn a reward in the form of Bitcoins. These are called “Mining Rewards”. Currently a miner earns 6.25 Bitcoins for successfully processing a batch of transactions. This means the miner is award with about $240,000 USD worth of Bitcoins based today’s price.

Upon Bitcoin halving, the Mining Rewards will be cut to 3.125 Bitcoins per batch of transactions from 6.25 Bitcoins. 3

The Bitcoin software states that after every 210,000 batches of transactions4, the mining rewards will be cut in half. The halving process is enforced through computer source code.

The following is a quick visualization on how much Bitcoin is issued to the miners vs its price:

Why does halving matter?

The halving policy was written into Bitcoin’s software to counteract inflation by maintaining scarcity. 5 Digital scarcity enforced through computer algorithm gives Bitcoin its value.6

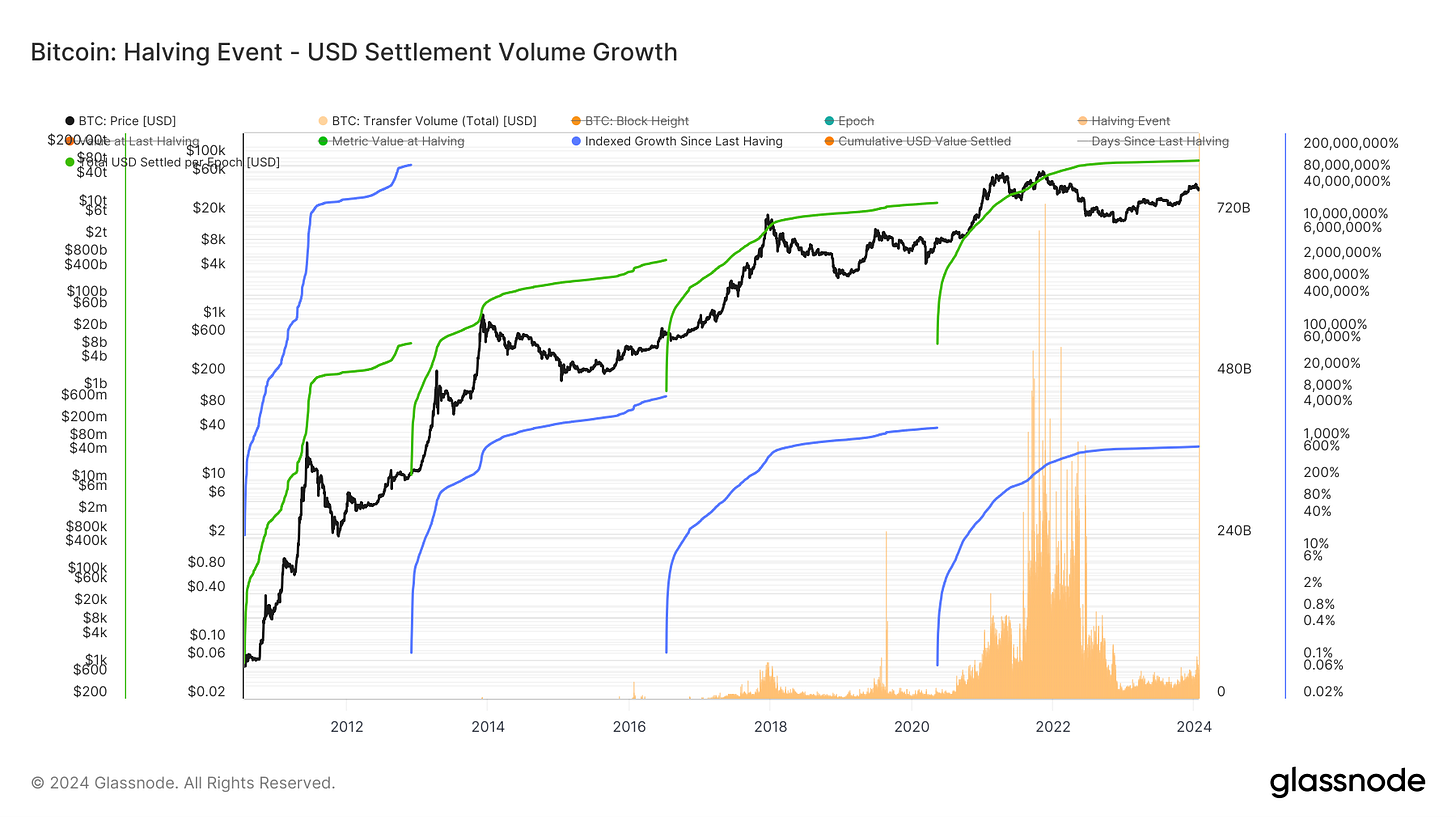

Post previous halving events, we have seen impressive growth in USD settlement volume and new participants in Bitcoin’s network.

Bitcoin network’s total settlement value in USD has seen exponential growth post halving. This means

More users enter into the Bitcoin network before and after the halving event, and

Increased transaction and usage of Bitcoin’s network

How does this affect Bitcoin?

Since the most natural source of selling Bitcoin are miners, the selling pressure of Bitcoin on a daily basis declines after the halving event.

Currently there are approximately 27,000 Bitcoin mined on a monthly basis. At price of $40,000 per Bitcoin, the monthly selling pressure from miners is about $1 billion. After the next halving, miner monthly selling will decrease to 13,500. Should demand remain the same, the price of Bitcoin would increase. 7

Historically, price and volatility of Bitcoin have dramatically increased post previous halvings:

Conclusion

Bitcoin halving is a once in a 4 year event that deserves attention. During the previous halvings we have seen dramatic price movements of Bitcoin. Historically the event captures the attention of existing investors as well as attracts incoming capital flow of new investors.

Combining this with the recent Bitcoin ETF approval, we are keen to observe the capital flow and analyze the pattern for the capital for Bitcoin as a bourgeoning digital commodity.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and is not intended as financial advice. The content is not meant to provide, and should not be relied upon for investment, accounting, legal, or tax advice. You should consult your own financial, legal, tax, or other professional advisors before engaging in any transaction. The views expressed on this blog are the author's own and do not necessarily reflect the views of any financial institutions or other entities. Investing in financial markets involves risks, and there is always the potential of losing money when you invest in securities. Past performance is not indicative of future results.

You can view and download the source code ran by every computer in the Bitcoin network here: https://github.com/bitcoin/bitcoin. It is an open source software which means it is free and made freely available for anyone to view and distribute.

There are computers on the Bitcoin network that does not process transactions. Instead, they run the Bitcoin software to validate transaction accuracy, further securing the network. They do not earn rewards for processing the transactions and hence they are not miners. Rather they are called “validators”.

Hence why the name “halving”: 3.125 is half of 6.25.

Each batch of transactions is called a "block”.

Bitcoin is digitally scarce because: 1. Not one entity can control and inflate the quantity of Bitcoin in circulation; 2. Its supply is programmatically declining over time, and 3. The max supply of Bitcoin is 21 million and is programmatically enforced through the Bitcoin software source code.

Without enforceable rules, digital assets are difficult to maintain value. Historically the problem with digital-native units of account is difficult to track and maintain value. For example, I can go onto my computer, type some code, and create or duplicate a new “coin”. But the coin would not have value because creating such new coin does not take much effort at all. This is because digital information can be reproduced relatively easily by savvy individuals.

Hence why blockchain is a breakthrough technology. It solves the problem that once a coin is created or spent, then it cannot be “created” or spent again. The double spending problem is not new. There has been numerous predecessors to Bitcoin that attempted to create a cryptographic secure payment system. See Chaum, D. (1982) “Blind Signatures for Untraceable Payments” https://www.hit.bme.hu/~buttyan/courses/BMEVIHIM219/2009/Chaum.BlindSigForPayment.1982.PDF

“Would” does not imply “will”, as various market factors can affect the price of Bitcoin. As with all markets, short term price movements are extremely difficult to predict. We will have a separate write up on Bitcoin demand and where does the demand come from.