Why Bitcoin Price is Pushing Towards $50,000 Yesterday

And Market Forces Driving the Recent Rally

As we have written in prior blog posts, there are a couple of tailwinds for Bitcoin this year:

In January US SEC approved Bitcoin spot ETF,

In April / May of this year, Bitcoin upcoming mining supply will be cut in half in an event called the “halving”

Bitcoin was trading close to $49,800 as of Tuesday at 11:22am London time1 on Feb 13, which is the highest price since December 2021.

Reason behind the recent rally can be mostly attributed to strong ETF inflow and demand since spot ETF approval. Since January 11, net inflow to Bitcoin ETFs totalled to $2.8 Billion, showing underlying demand for the digital asset:

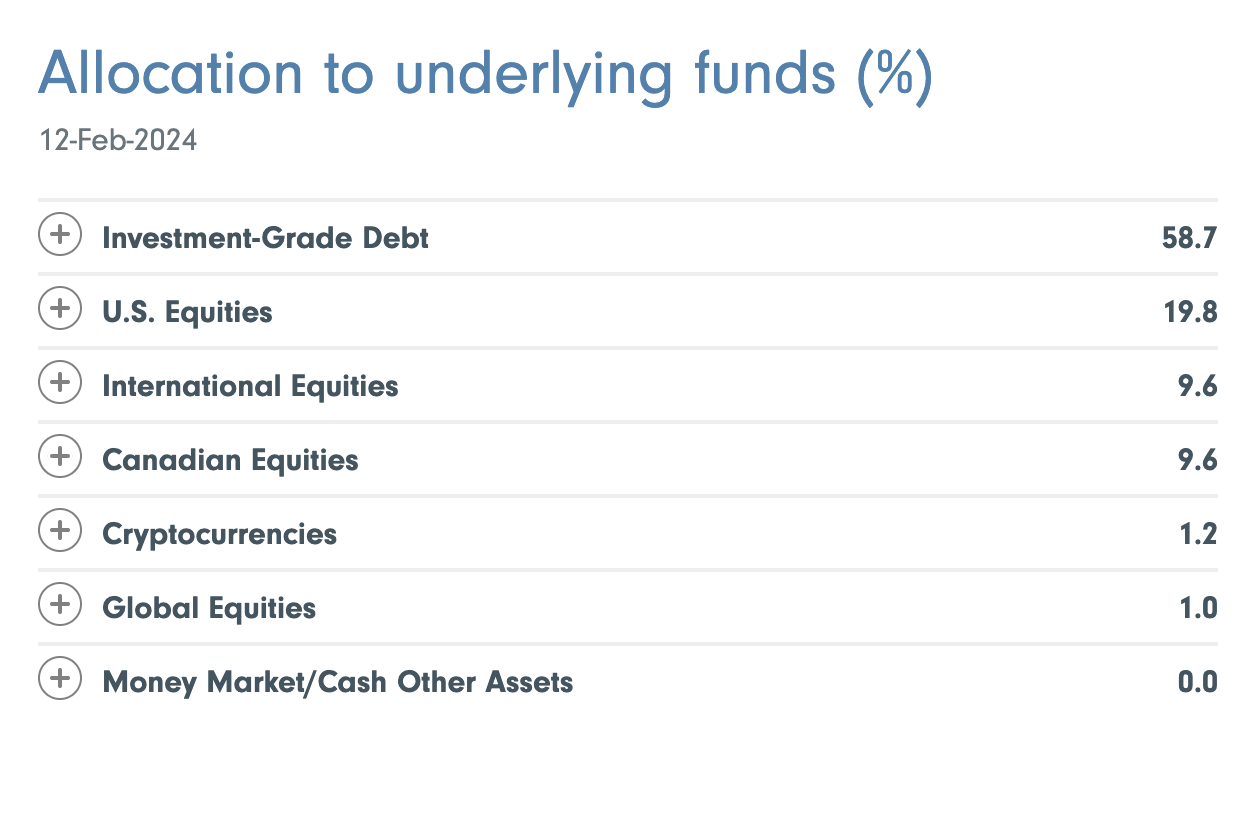

As the same time, Fidelity Canada quietly allocated 1.2% to Bitcoin in its Fidelity All-in-One Conservative ETF Fund. Again this shows growing demand from investors looking to diversify their portfolios:

Conclusion

We can see that the initial launch of US Bitcoin ETFs has been a success from a number of metrics such as inflow and added portfolio allocation from asset managers.

However, short term price movements of Bitcoin (or any asset) is nearly impossible to predict. As a firm, we advise our customers to use options and fixed income to get exposure to Bitcoin while agnostic to short term price movements. In other words: use options to get hedged exposure to an asset without risking too much.

So far we have seen the strategies performing as intended. We have been successfully helping many accredited investors get risk managed exposure to Bitcoin while carefully controlling the risk of loss. We shall continue to refine and better our products.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and is not intended as financial advice. The content is not meant to provide, and should not be relied upon for investment, accounting, legal, or tax advice. You should consult your own financial, legal, tax, or other professional advisors before engaging in any transaction. The views expressed on this blog are the author's own and do not necessarily reflect the views of any financial institutions or other entities. Investing in financial markets involves risks, and there is always the potential of losing money when you invest in securities. Past performance is not indicative of future results.

Source: Bloomberg https://www.bloomberg.com/news/articles/2024-02-12/bitcoin-btc-hits-50-000-for-the-first-time-since-2021-on-etf-demand